Bitcoin and other cryptocurrencies are receiving intense media coverage, prompting many investors to wonder whether these new types of electronic money deserve a place in their portfolios, even in spite of it’s volatility.

Background of Cryptocurrencies and Bitcoin:

Cryptocurrencies such as bitcoin emerged only in the past decade. Unlike traditional money, no paper notes or metal coins are involved. No central bank issues the currency, and no regulator or nation state stands behind it. Instead, cryptocurrencies are a form of code made by computers and stored in a digital wallet. In the case of bitcoin, there is a finite supply of 21 million, of which more than 18.5 million are in circulation.Transactions are recorded on a public ledger called blockchain. People can earn bitcoins in several ways, including buying them using traditional fiat currencies or by “mining” them—receiving newly created bitcoins for the service of using powerful computers to compile recent transactions into new blocks of the transaction chain through solving a highly complex mathematical puzzle.

For much of the past decade, cryptocurrencies were the preserve of digital enthusiasts and people who believe the age of fiat currencies is coming to an end. This niche appeal is reflected in their market value. For example, at a market value of $57,000 per bitcoin, the total value of bitcoin in circulation is less than half of a percent of the aggregate value of global stocks and bonds. Despite this, the sharp rise in the market value of bitcoins over the past weeks and months have contributed to intense media attention.

How To Make Sense Of All The Media Hype For Bitcoin:

What are investors to make of all this media attention? What place, if any, should bitcoin play in a diversified portfolio? Recently, the value of bitcoin has risen sharply, and also declined sharply, but that investment result is the past. What about its future value? You can approach these questions in several ways. A good place to begin is by examining the roles that stocks, bonds, and cash play in your portfolio.

Expected Returns:

Companies often seek external sources of capital to finance projects they believe will generate profits in the future. When a company issues stock, it offers investors a residual claim on its future profits. When a company issues a bond, it offers investors a promised stream of future cash flows, including the repayment of principal when the bond matures. The price of a stock or bond reflects the return investors demand to exchange their cash today for an uncertain but greater amount of expected cash in the future. One important role these securities play in a portfolio is to provide positive expected returns by allowing investors to share in the future profits earned by corporations globally.

Stocks and Bonds:

By investing in stocks and bonds today, you expect to grow your wealth and enable greater consumption tomorrow. Government bonds often provide a more certain repayment of promised cash flows than corporate bonds. Thus, besides the potential for providing positive expected returns, another reason to hold government bonds is to reduce the uncertainty of future wealth. And inflation-linked government bonds reduce the uncertainty of future inflation adjusted wealth.

Cash:

Holding cash does not provide an expected stream of future cash flow. One US dollar in your wallet today does not entitle you to more dollars in the future. The same logic applies to holding other fiat currencies — and holding bitcoins in a digital wallet. So we should not expect a positive return from holding cash in one or more currencies unless we can predict when one currency will appreciate or depreciate relative to others. The academic literature overwhelmingly suggests that short-term currency movements are unpredictable, implying there is no reliable and systematic way to earn a positive return just by holding cash, regardless of its currency.

So why should investors hold cash in one or more currencies? One reason is because it provides a store of value that can be used to manage near-term known expenditures in those currencies. With this framework in mind, it might be argued that holding bitcoins is like holding cash; it can be used to pay for some goods and services. However, most goods and services are not priced in bitcoins. A lot of volatility has occurred in the exchange rates between bitcoins and traditional currencies. That volatility implies uncertainty, even in the near term, in the amount of future goods and services your bitcoins can purchase. This uncertainty, combined with possibly high transaction costs to convert bitcoins into usable currency, suggests that the cryptocurrency currently falls short as a store of value to manage near-term known expenses. Of course, that may change in the future if it becomes common practice to pay for all goods and services using bitcoins. If bitcoin is not currently practical as a substitute for cash, should we expect its value to appreciate?

Supply And Demand:

The price of a bitcoin is tied to supply and demand. Although the supply of bitcoins is slowly rising, it may reach an upper limit, which might imply limited future supply. The future supply of cryptocurrencies, however, may be very flexible as new types are

developed and innovation in technology makes many cryptocurrencies close substitutes for one another, implying the quantity of future supply might be unlimited.

Regarding future demand for bitcoins, there is a non-zero probability that nothing will come of it (no future demand) and a non-zero probability that it will be widely adopted (high future demand). Future regulation adds to this uncertainty. While recent media attention has ensured bitcoin is more widely discussed today than in years past, it is still largely unused by most financial institutions. It has also been the subject of scrutiny by regulators. For example in a note to investors in 2014, the US Securities and Exchange Commission warned that any new investment appearing to be exciting and cutting-edge has the potential to give rise to fraud and false “guarantees” of high investment returns. Other entities around the world have issued similar warnings.

It is unclear what impact future laws and regulations may have on bitcoin’s future supply and demand (or even its existence). This uncertainty is common with young investments. All of these factors suggest that future supply and demand are highly uncertain. But the probabilities of high or low future supply or demand are an input in the price of bitcoins today. That price is fair, in that investors willingly transact at that price. One investor does not have an unfair advantage over another in determining if the true probability of future demand will be different from what is reflected in bitcoin’s price today.

What To Expect For Bitcoin:

So, should we expect the value of bitcoins to appreciate? Maybe. But just as with traditional currencies, there is no reliable way to predict by how much and when that appreciation will occur. In it’s 12 years of existance, bitcoin has crashed between 70% and 80% four times. Investors in bitcoin should understand the asset’s history and be comfortable with the possibilty of similar crashes in the future. We know, however, that we should not expect to receive more bitcoins in the future just by holding one bitcoin today. They don’t entitle holders to an expected stream of future bitcoins, and they don’t entitle the holder to a residual claim on the future profits of global corporations.

None of this is to deny the exciting potential of the underlying blockchain technology that enables the trading of bitcoins. It is an open, distributed ledger that can record transactions efficiently and in a verifiable and permanent way, which has significant implications for banking and other industries, although these effects may take some years to emerge.

Bitcoin’s Place In A Portfolio:

When it comes to designing a portfolio, a good place to begin is with one’s goals. This approach, combined with an understanding of the characteristics of each eligible security type, provides a good framework to decide which securities deserve a place in a portfolio. For the securities that make the cut, their weight in the total market of all investable securities provides a baseline for deciding how much of a portfolio should be allocated to that security.

Unlike stocks or corporate bonds, it is not clear that bitcoins offer investors positive expected returns. Unlike government bonds, they don’t provide clarity about future wealth. And, unlike holding cash in fiat currencies, they don’t provide the means to plan for a wide range of near-term known expenditures. Because bitcoin does not help achieve these investment goals, we believe that it does not warrant a place in a portfolio designed to meet one or more of such goals.

If, however, one has a goal not contemplated here, and you believe bitcoin is well suited to meet that goal, keep in mind the final piece of our asset allocation framework: What percentage of all eligible investments do the value of all bitcoins represent? When compared to global stocks, bonds, and traditional currency, their market value is tiny. So, if for some reason an investor decides bitcoins are a good investment, we believe their weight in a well-diversified portfolio should generally be tiny. Because bitcoin is being sold in some quarters as a paradigm shift in financial markets, this does not mean investors should rush to include it in their portfolios. When digesting the latest article on bitcoin, keep in mind that a goals-based approach based on stocks bonds, and traditional currencies, as well as sensible and robust dimensions of expected returns, has been helping investors effectively pursue their goals for decades.

Sandbox Account for Bitcoin:

The logic of building a well-diversified portfolio which meets your investment goals is undeniably the most beneficial way to approach investing, however many clients also enjoy dabbling in individual stocks or cryptocurrencies just for the fun of it. For a small percentage of the total household assets, it’s OK to have a play account or a sandbox account. This account is purely for entertainment, similar to having a savings account for a trip to Las Vegas to go gambling. If you lose all the money, it’s OK because it doesn’t jeapordize your financial goals and you still have fun along the way. If you gain more money, it’s even more fun because now you have extra money to perhaps spend on some financial goals that didn’t fit into your financial plan before the winnings. But it is gambling, and not investing.

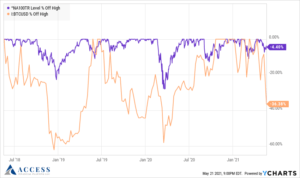

Click on the graph belows to see the volatility in Bitcoin’s price compared to volatility in the NASDAQ index return by showing the percentage the price has dropped below it’s high price. It’s a lot of bounding around to stomach if your financial goals are riding on it.

As always, if you would like more information on investments or any other financial planning topic, please contact me. Find out more about Access Financial Planning, LLC here

Disclaimer: This article is provided for general information and illustrations purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult with a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Tricia Rosen, and all rights are reserved. Read the full disclaimer.