It’s hard to ignore all the hype around the high-flying stocks which are in the news lately, and you might feel like you are missing out while others are living the dream. Even for the most conservative investors, it’s easy to feel like you may need to find the cure for investment FOMO. The fear of missing out (FOMO) on a potentially large increase in your investment holdings is very real for many investors.

Missing The Excitement – Investment FOMO

If you are investing in a low-cost, well diversified target date fund in your 401(k), you might feel like you are missing the gravy train right now. But that’s one of the paradoxes of successful investing. When it’s working as it should, it feels boring. It doesn’t make exciting conversation with friends or neighbors, so you don’t hear much about others taking the same path. Investment FOMO can start to set in when others are talking about the big wins.

At the same time, it can also feel very unsettling when big stock market movements are in the news, whether it’s postive or negative news. And you just stay the course, plugging along. When the stock market took a nose dive in March 2020, it took courage to trust the process and not panic. It’s easy to question yourself and to worry you are making a mistake that you’ll regret.

Confusion and doubt often muddy the waters. That stock went up, why? Wait, that one lost money, why? Should I sell my winners? Should I buy my losers? I should have sold that stock yesterday before it went down today. It doesn’t make sense for GameStock to shoot up in value. If that guy could figure out how to ride the wave, I could too. That thought has crossed most investor’s minds at one point or another.

Time Puts Investment FOMO in Perspective

Chasing after astronomical returns can feel a lot like chasing the wind, and the wind can disappear just as quickly as it came. Catching the high-flyers can be elusive. But there remains a plethora of ways you can build wealth long-term while also sleeping well at night. The most common and time tested way is to invest in a well diversified portfolio of low-cost, professionally managed funds, making consistent contributions to your account over time.

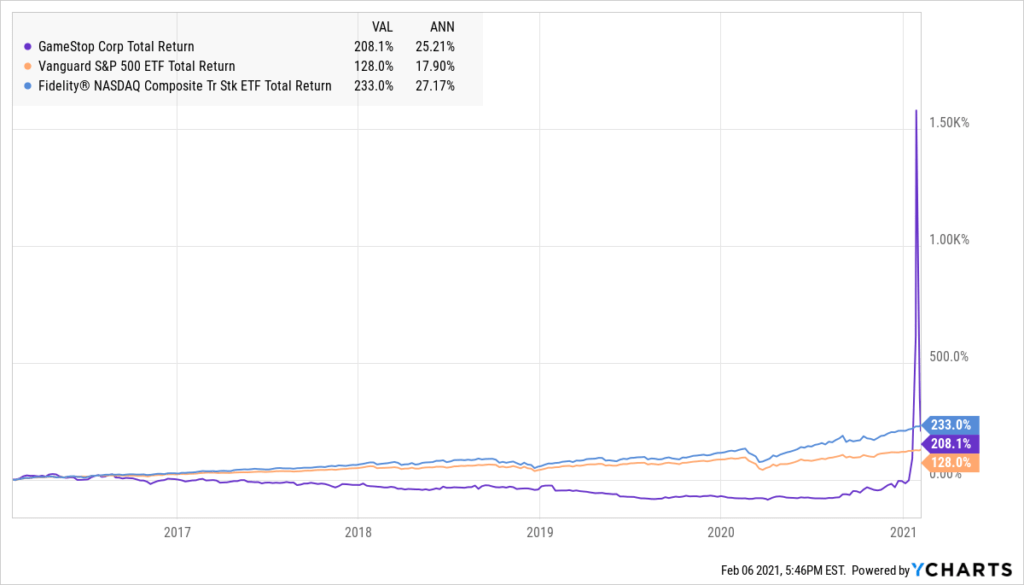

To put it into perspective, the chart below shows the return for GameStop compared to the return for Vanguard S&P 500 ETF and Fidelity® NASDAQ Composite ETF over 5 years. You would end up with roughly the same annualized return. But without the sleepless nights caused by worrying about big swings in price. Of course past performance is not an indication of future performance, but hopefully the chart will put your mind at ease that if you put your money into the boring, low-cost, well diversified funds, you didn’t miss out in a meaningful way over the longer term. And you didn’t get sea sick along the way either.

Barriers to Trading Knocked Down

In general it’s great that investing has become much more accessible to more people because it is one fo the few ways to build meaningful wealth. However, it’s become almost too easy to invest. The elimination of fees for trades makes it more economical to trade more often and for smaller positions. Fractional shares makes buying even high priced securities more accessible to more people. The introduction of trading apps, including RobinHood, makes it so simple to trade that it feels like playing a game on your phone. The downside is most people don’t really understand what they are agreeing to and can sometimes make mistakes. But it’s real money at stake and your investment can be wiped out more quickly than you realize. When investment FOMO kicks in, it’s very easy to jump into the pool with others even if you haven’t learned how to swim yet.

People routinely overstimate their abilities in trying to outsmart other investors and beat the market. Most of them fail, but you won’t hear them bragging about it to their friends and neighbors. This makes it feel like everyone else has had great success and you’ve been sitting on the sidelines. Thankfullly, most investors who stay within their limits, keeping costs low and diversifying widely, will prevail over time.

Sandbox Money – Investment FOMO Solution

For investors who enjoy the excitement of participating in the market, there is a solution which will let you sleep at night and still have some entertainment with investing. After doing some financial planning analysis, determine how much of your portfolio you could potentially afford to lose and still not have it effect your lifestyle, retirement plans or other financial goals. That small percentage of your portfolio, generally not more than 10% of your total portfolio, could be your investment FOMO account.

This is the account where you can invest in the company where you really love their product and think they will do well. Or the comany which is doing great things which support your values and you want to invest in the company. Or the company that you think will be the next one to have their share price take off like a rocket to the moon. But if any of them fail, it’s OK. The exception of course is if you trade with options, you can get into trouble if the company fails and you don’t understand what you’ve purchased. So stick with buying stocks in your investment FOMO account without options. You still enjoy the process of researching the companies, buying the stocks, watching the companies and hoping they do well. And if they don’t, it doesn’t change your lifestyle or plans but you had some fun entertainment along the way.

Where to Begin Your Investment FOMO Solution

Spolier alert – it’s not with RobinHood.

There are many places an individual investor can begin investing. RobinHood has gained a lot of popularity because of it’s ease of use and aggressive marketing, especially among the college-aged and early career investors. But RobinHood has many flaws including when an investor first opens an account it is a marigin account by default which has different rules than a non-margin account, the company has run into regulatory trouble for various reasons including failing to satisfy duty of best execution, difficulty reaching a representative by phone when needed, among other significant concerns. It’s hard enough for an experienced investor to understand what they are getting into when they invest with RobinHood, it’s even harder for an inexperienced investor to understand it.

There are several alternative places to begin investing which are more transparent with what they are doing, more accessible for trading support, and more accustomed to abiding by compliance regulations. Since no trading fees have become common place and the ability to purchase fractional shares is becoming more common too, there isn’t as much of a difference between the various platforms for trading. Some reputable places to start are Fidelity, Schwab, ETrade, Merrill Edge, and Interactive Brokers. TD Ameritrade also makes the list, but they were bought out by Schwab and will be going through a merger over the next couple of years so I wouldn’t start there if you are opening a new account.

For investment education, the Fidelity website has plenty of helpful information. If you want a more structured approach, Next Generation Personal Finance has on-line courses to learn more about investing and personal finance topics and a free on-line resource to learn more about investing from the agency which regulates the investment industry, FINRA, is here.

As always, if you would like more information on investments or any other financial planning topic, please contact me. Find out more about Access Financial Planning, LLC here

Disclaimer: This article is provided for general information and illustrations purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult with a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Tricia Rosen, and all rights are reserved. Read the full disclaimer.