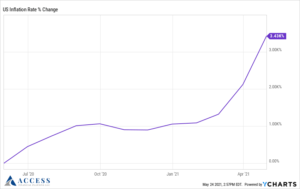

We’ve all heard the stories or have been affected by it directly. Rising prices and short supply for items like lumber, chlorine for the pool, and toilets for your bath renovation are becoming increasingly common. Add to that the stimulus infusion into the economy and the economy rebounding after loosening of pandemic restrictions, and inflation concerns are bound to increase. The United States inflation rate increased from a year earlier by 2.62% in March 2021 and by 4.16% in April 2021, blowing past analysts’ expectations for a 2.3% gain, further igniting inflation fears. The next Consumer Price Index report is due out June 10 for the month of May. Some analysts believe the increase in inflation is transitory and will lesson over time. But how do you protect your portfolio if there is a significant increase in inflation in the future?

Inflation Concerns:

The dramatic rise in inflation over the past couple of months can be seen in the chart below:

Options For Inflation Concerns:

One of the more popular investment options for hedging against inflation are hard assets such as gold. However, investors face near record prices for gold, the most commonly used inflation hedge. The price for a troy ounce of gold was $1,838.10 on May 24, 2021. It reached as high as $1,895 per troy ounce in 2011 when inflation moved higher then too.

Other assets generally thought to safeguard investors against inflation fell after the recent Consumer Price Index report showing an increase in inflation rates, where intuitively they would be expected to rise due to increased demand. For example, the price of the benchmark 10-year Treasury inflation-protected security had its biggest one-day decline in a month. Shares of real-estate investment trusts slid the most since January. Commodities were generally flat but dropped the day following the Consumer Price Index Report was released. These asset classes have vacillated since then, but their inital movements showed the unexpected ways that markets can behave when inflation is rising, especially when many were already expensive by historical measures.

Some investors have turned to alternative investments to hedge inflation fears, including cryptocurrency. However the volatility of cryptocurrency makes it an ineffective inflation hedge in most portfolios. Commodities also can be very volatile and are influenced by an array of idiosyncratic factors, but some analysts are optimistic about their long-term outlook. They argue that commodities, from corn to copper, could be supported by continued strong demand from consumers and a relatively limited supply, due to many natural resources companies taking a conservative approach to production.

The Stakes Are High:

Inflation dents the value of traditional government and corporate bonds because it reduced the purchasing power of their fixed interest payments. But it can also hurt stocks by pushing up interest rates and increasing the cost of running the business for companies. However, protecting against inflation is tricky.

Depending on the investor’s risk tolerance profile, another option for combating the effects of inflation is investing in a portfolio of stocks which will outperform inflation. The downside is typically higher performance is associated with higher risk, and the higher risk may not be approprate for all investors.

Treasury Inflation-Protected Securities:

Treasury inflation-protected securities, or TIPS, offer the most straightforward option as a hedge against inflation, as their interest payments and principal automatically increase when Consumer Price Index rises. When investors buy TIPS, the yields on the securities are lower than nominal Treasurys of the same maturity, but investors can ultimately earn a better return depending on the rate of inflation over the life of the bond. Recently the yield on a 10-year TIPS was negative, meaning investors would lose money if there was no inflation. A nominal 10 year Treasury note in comparison was earning about 1.6%. That means that the Consumer Price Index growth would need to average at least 2.45% over the next 10 years for the inflation-protected security to pay as much or more than the nominal Treasury.

To some, this makes the TIPS the safest bet as an inflation hedge because at current yields they can earn significanlty more than regular Treasurys if inflation fears are realized. However, TIPS returns are likely to be low under almost any scenario, especially if inflation doesn’t rise as expected. TIPS prices can also fall along with nominal Treasuries when investors think rising inflation will push the Fed to raise short-term rates and the current notes will fall out of favor.

How To Protect Your Portfolio:

When all is said and done, what is an investor to do to protect their portfolio when there are inflation concerns? The answer is the standard financial planning answer: It depends. As with all investment decisions, the best way to make a decision is to look at your entire portfolio of assets, determine the goals and time-line for the assets, determine the appropriate risk level, and then determine which solution is best for your specific situation. The standard inflation hedges may not be the most advantageous answer. But most likely neither is cryptocurrency.

The portfolio analysis is especially important for retirees or those who plan on retiring soon because their portfolio will be their source of income. Inflation can cause problems both with an increase in the cost of living and at the same time potentially creating lower returns on the portfolio assets. However, the effects of inflation should be considered for all investors, not just retirees or soon to be retirees. A review of non-traditional assets which may be used to hedge against a potential increase in inflation is worthwhile for all portfolios.

As always, if you would like more information on investments or any other financial planning topic, please contact me. Find out more about Access Financial Planning, LLC here

Disclaimer: This article is provided for general information and illustrations purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult with a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Tricia Rosen, and all rights are reserved. Read the full disclaimer.